Risk Management

Due to its role in ensuring the smooth operation of the market as a central counterparty, ATHEXCLEAR (CCP) is exposed to and manages the following main categories of risks:

- Counterparty Credit Risk

- Liquidity Risk

- Operational Risk

To ensure effective risk management, the organizational structure encompasses the following levels:

- Board of Directors, which has the ultimate responsibility and accountability for the management of the company's risk management function

- Risk Committee (Resolution 9), which advises the Board of Directors on risk management issues

- Default and Crisis Management Committee, an executive committee appointed by the Board of Directors responsible for managing defaults and day-to-day risk management issues

- Risk Management Unit, responsible for a comprehensive approach to risk with the aim of identifying, evaluating, and ultimately managing risks

- Chief Risk Officer, the head of the Risk Management Unit, who reports directly to the Board of Directors or through the Chairman of the Risk Committee and implements the risk management framework established by the Board of Directors

- Organizational Units, responsible for identifying and managing risks within their respective areas of operation

Counterparty Credit Risk

To cover Counterparty Credit Risk vis-a-vis its Clearing Members (CM), ATHEXCLEAR monitors and calculates margin (market risk) on a daily basis (end-of-day but also intraday in near real-time basis) for each clearing account which is then covered by corresponding collateral in the form of cash and/or selected transferable securities that is pledged by Clearing Members.

Eligible transferable securities, the maximum valuation limit and the applicable haircuts are updated on a monthly basis and/or at an ad-hoc basis if deemed necessary and are posted here.

On the basis of the amount of pledged collaterals, the Clearing Members obtain a credit limit which they can allocate to their affiliated Trading Members (TM). The Trading Member’s credit limit is updated on an ongoing basis depending on its consummation (orders/trades).

ATHEXCLEAR manages the Default Funds (DF) of both markets (securities and derivatives) which are risk-sharing funds; Clearing Members contribute to each Default Fund only in the form of cash. The minimum Default Fund share of each Clearing Member is recalculated on a monthly basis in accordance with the provisions of the rulebooks to ensure that their size is adequate to meet at any time the requirements laid down by the EMIR Regulation (EU) 648/2012 (Cover 1, 2). In addition, ATHEXCLEAR holds separately for each Default Fund special own pre-funded financial resources ('Skin in the Game'-SIG) in cash to cover potential losses in the event of Clearing Member default.

The effectiveness of the risk management models, the value of their parameters, the adequacy of default fund amounts and the liquidity resources are examined on a regular or extraordinary basis under extreme but plausible market conditions (Margin/Haircut Back-Testing, Sensitivity Analysis, Credit and Liquidity Stress Test, Reverse Stress Test etc.).

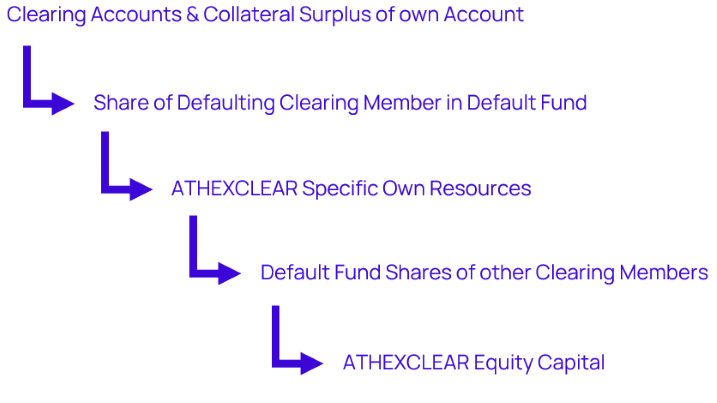

In the event of a Clearing Member default ATHEXCLEAR activates the default waterfall where the different loss absorption resources apply with the following order:

Liquidity Risk

The aim of ATHEXCLEAR is to maintain a sufficient level of liquidity so as to ensure fulfilment of same-day and, where appropriate, intraday settlement of payment obligations in all relevant currencies. When assessing the level of liquidity requirements, both the operational liquidity requirements and those arising from the default of the two largest Clearing Member groups with the largest exposure to liquidity risk are taken into account.

The available liquidity sources for each clearing service are:

- cash collaterals deposited by all Clearing Members (based on the Right of Use clause according to the authorization provided to ATHEXCLEAR in accordance with its regulations)

- cash from the Default Fund shares

and for both clearing services are:

- ATHEXCLEAR's own liquid resources

The available liquidity of ATHEXCLEAR is examined for each market separately (Securities, Derivatives) according to the criteria laid down by EMIR Regulation (EU 648/2012). ATHEXCLEAR examines on a daily basis separately for each clearing system and under extreme but plausible market conditions, whether it has sufficient liquid resources to cover the liquidity needs arising from the default of the two (2) groups of associated Clearing Members against which it has the highest liquidity needs when closing out their positions (Cover 2).

Testing and Review of Models and Procedures

Parameters as well as the methodologies of ATHEXCLEAR's risk management and haircut models are subject to a monthly, quarterly and yearly statistical acceptance test, while the adequacy of the margining models are subject to day-to-day statistical portfolio coverage tests. Also, on a monthly basis, sensitivity analysis of the required margin at portfolio and market level is carried out by simulating changes in parameter values of the risk management model.

According to EMIR requirements the adequacy of the Default Fund is assessed daily against counterparty credit risk events under extreme but plausible market conditions for each Default Fund separately. Hence the central counterparty shall cover with prefunded financial resources the default of the Clearing Member group in which it has the largest risk exposure in terms of loss or that of the 2nd & 3rd largest Clearing Member group if the loss is higher (Cover 1). Additionally, it has to cover the risk exposure of the 1st & 2nd largest Clearing Member group including SIG (Cover 2). The Default Fund adequacy is evaluated on a quarterly basis, based on the determination and the assessment of those market scenarios that lead to its exhaustion (reverse stress testing).

The adequacy of liquidity is reviewed daily by stress testing the liquid resources against counterparty credit risk events under extreme but plausible market conditions for each clearing fund separately. Also, on a quarterly basis, those scenarios are examined that lead to the exhaustion of liquid financial resources (reverse stress test).

On a yearly basis, an assessment of the adequacy of the correlation assumptions is performed for each portfolio margin model separately.

On an annual basis, the risk management models, the methodologies and the stress test framework are also reviewed.

On a yearly basis, a default exercise of a clearing member(-s) is carried out (fire drill). The exercises carried out under the supervision of the Hellenic Capital Market Commission, while participants are Clearing and Trading Members, the Athens Exchange as Market Operator, the Default and Crisis Management Committee, the Financial Services Division; the Risk Management Unit and the Clearing and Settlement Unit of ATHEXCLEAR act as coordinators. The aim of the exercise is to ascertain the readiness of the participants, as well as the adequacy of the models and procedures in dealing with the default of one or more Clearing Members.

Operational Risk

The Operational Risk Framework of ATHEXCLEAR sets out the principles and procedures for the management of operational risk, as well as the roles and responsibilities which have been assigned. The framework stipulates the various procedures for identifying, evaluating, mitigating and monitoring risk. The main components of the framework are:

- Identification of possible risks by means of a risk and control self-assessment (RCSA) process

- Collection of data related to actual events which led to or could lead to losses

- Development of action plans and establishment of Key Risk Indicators (KRI) for addressing and monitoring risks

Securities Market

The provision of clearing services by ATHEXCLEAR in the Securities Market of Athens Exchange requires that strict Risk Management procedures are in place, which are described in the "Regulation of Clearing of Transferable Securities Transactions in Book Entry Form" and the Resolutions of the ATHEXCLEAR Board of Directors.

Risk is calculated for the Securities Market on a daily basis at Clearing Account level and involves:

- calculation of the Margin for covering the risk arising from unsettled transactions of previous days

- calculation of the Risk arising from orders and transactions of the trading day

The Margin for the pending unsettled transactions of each Clearing Account derives from the sum of the General Risk, the Specific Risk and the profit or loss (Mark-to-Market) which results from the valuation of open positions at the last available closing prices.

General Risk takes account of the possible change in the price of the Security which is correlated with the overall Market change (only for securities that such a correlation exists).

Specific Risk relates to the possible change in the price of the Security which is not directly connected with the Market change.

The Mark-to-Market valuation takes into account the price at which each transaction is carried out and the last available closing price of the Security.

Prices used for the risk calculation are announced by Athens Exchange on its website.

Intraday Risk is the aggregate Risk arising from active orders and from trades already concluded during the trading day.

Intraday Risk is calculated by the Trading System itself and enables the rejection of an order if the Order Risk results in Intraday Risk greater than the available Credit Limit.

To reduce the margin provision requirements, ATHEXCLEAR enables its Direct Clearing Members to declare that a sell order is "covered", so that when it is entered in the order book it is excluded from the calculation of Order Risk. A covered sell order placed in the Market is activated after the Securities to which the sell order relates have first been blocked in the Dematerialized Securities System (DSS) in favour of ATHEXCLEAR. Correspondingly, sells that result from such orders (covered sells) are not taken into consideration in risk calculation.

The risk management methodology is described in detail in Resolution 6 of the ATHEXCLEAR Board of Directors.

| FILE NAME | TYPE |

| Announcement | Download PDF |

| Risk Management Parameters (effective as of 05/04/24) | Download PDF |

| Risk Management Parameters (effective as of 04/04/24) | Download PDF |

Derivatives Market

The provision of clearing services by ATHEXCLEAR in the Derivatives Market of Athens Exchange requires that strict Risk Management procedures are in place, which are described in the "Regulation on the Clearing of Transactions on Derivatives" and the Resolutions of the ATHEXCLEAR Board of Directors.

To mitigate Counterparty Credit Risk, the settlement amount (daily settlement / variation margin) is calculated and paid daily for all the position accounts included in each clearing account. This amount is calculated based on the daily settlement prices (fixing) of financial products as announced by Athens Exchange on its website.

In addition, Margin is calculated daily and close to real time during the trading session. This calculation is made at Clearing Account level for all Clearing Members.

The calculation of Margin relates to the risk from possible future fluctuations in the prices of financial products and is based on the open positions of the Clearing Account, the historical volatility of underlying assets and daily mark-to-market prices. The calculation of the daily margin requirement is made by using a Risk Valuation (RI.VA.) model, which is based on an estimation of the maximum negative change in the value of an open position due to price volatility of the underlying asset during a period that will be needed by ATHEXCLEAR to cover any losses from closing that position in the market. RI.VA. calculations depend on the following parameters:

- the Valuation Interval (%) for Futures and Options

- the Adjustment Factor (%) for Futures

- the Fixed Volatility (%) for Options

- the Volatility Interval (%) for Options

- the Risk-Free Rate (%) for Options

- the Margin (%) for Securities Lending Products

- the Inclusion of an Instrument in a Correlation Group (Window Class)

The collateral provided and deposited by a Clearing Member for each clearing account minus the calculated Margin determines the available credit limit that may be used during a trading session when entering orders and conducting transactions.

The risk management methodology is described in detail in Resolution 5 of the ATHEXCLEAR Board of Directors.

Risk Neutral Position of the Electricity Market

The calculation of the initial margin (initial margin - ΙΜ) is applied after the elimination of opposite future contracts which are overlapping in terms of delivery period, completely or partially. The remaining position after eliminating overlapping series is called Risk Neutral position.

The conditions for calculating initial margin in case of a perfect or partial Risk Neutral position exist when the overlapping series have the same load profile (Base or Peak) and constitute a subset of the delivery period of the series with the longest duration.

Perfect overlapping exists when annually or quarterly contracts are completely overlapped by equal and opposite positions quarterly or monthly contract respectively. In this case, initial margin is not calculated.

Partial overlapping exists when annually or quarterly contracts are partially overlapped by opposite positions in quarterly or monthly contracts respectively. In this case, the initial margin calculation is done only for the missing contracts that need to be filled in order to form a perfect overlap.

The eliminations are done at clearing account level, where initial margin requirement is due.

For information purposes, the above calculations are also done at position account level.

| FILE NAME | TYPE |

| Announcement | Download PDF |

| Risk Management Parameters (effective as of 04/04/24) | Download PDF |

| Risk Management Parameters (effective as of 13/03/24) | Download PDF |

Credit & Liquidity Stress-Test Results

Initial Margin and Haircut Parameter Back-testing Results:

Learn More for ATHEXCLEAR's Risk Management Model and Methodology.