Throughout its long history, Athens Stock Exchange has become a cornerstone of the Greek and regional economy. As a forward-thinking organization, we continuously innovate, championing transparency, extroversion, and financial prosperity. Our legacy of experience and knowledge forms a solid foundation for fostering stable market development and a prosperous future.

Historical Insights

1876-1913: Establishment and Early Years

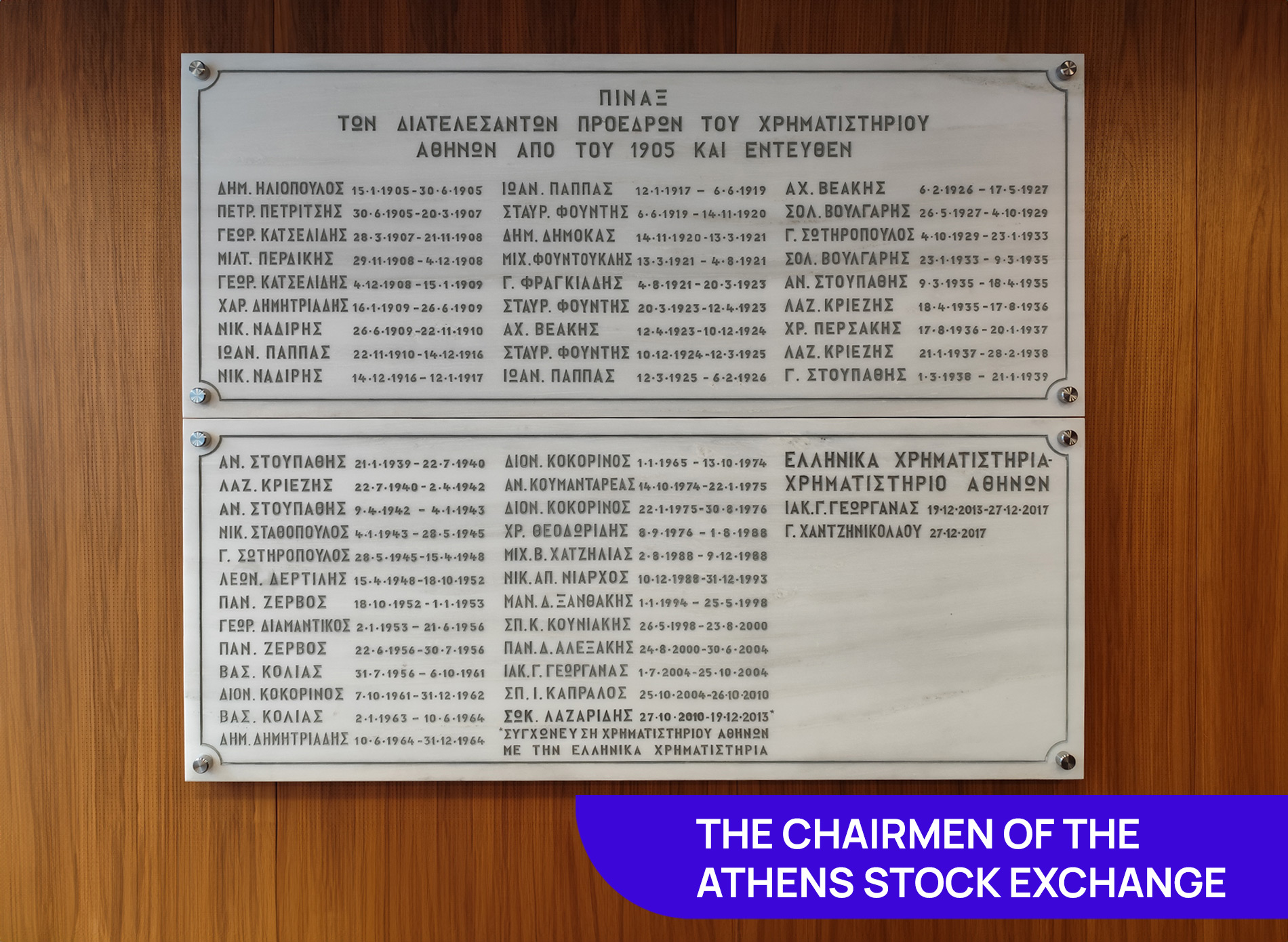

- The history of the Athens Stock Exchange began on September 30, 1876, when the government of Alexandros Koumoundouros issued the decree for its establishment. The Exchange’s first location was the Melas Mansion, which had previously served as the central post office. It remained there until the end of September 1881.

- The first set of operational regulations for the Stock Exchange was published in the Government Gazette on November 12, 1876.

- On May 2, 1880, the Stock Exchange officially began its operations, with trading taking place daily from 4:00 PM to 5:00 PM, excluding Sundays and public holidays.

- In October 1881, the Stock Exchange moved to a new building at the corner of Aiolou and Sofokleous Streets, where it remained until 1885.

- Between 1881 and 1883, there was a surge in the registration of new members.

- The period of rising prices from 1881 to 1884 was followed by the crisis of 1884, one of the most severe financial crises the Exchange had faced, caused by the broader economic difficulties of the time.

- In 1885, the Stock Exchange moved to a building at 11 Sofokleous Street, where it stayed until October 1891. On November 1, 1891, it relocated to a new headquarters at 1 Pesmazoglou Street.

1914-1949: Wars and Crises

- During World War I, the Athens Stock Exchange closed for the first time on July 16, 1914. It resumed operations on December 28 of the same year.

- In 1918, the Athens Stock Exchange was officially established as a public legal entity, solidifying its role in the country's financial system.

- The global economic downturn of 1929 impacted the Greek market with a delay, leading to a suspension of trading in September 1931. The Exchange reopened in December 1932.

- In November 1934, the Stock Exchange moved into a new building at 10 Sofokleous Street, previously owned by the National Bank of Greece. The building was inaugurated with great ceremony on December 19, 1934, marking the Exchange's fifth location since its founding.

- When World War II began, the Stock Exchange continued to operate normally until the German occupation of Athens. After that, it operated intermittently until the war’s end.

- Following the conclusion of the Civil War in August 1949, demand for shares saw a significant surge, continuing into the early 1950s.

- Up until 1950, all shares, except those of the Bank of Greece, were bearer shares. In April 1950, the American economic mission recommended to the Minister of National Economy that shares be registered for taxation purposes. Despite opposition from the President of the Athens Stock Exchange at the time, the process of registering shares was completed.

1950-1980: Post-War Reconstruction and Institutional Reforms

- In late 1964, the Athens Stock Exchange introduced and implemented the General Price Index.

- Law 148/1967 laid the foundation for the establishment of the Capital Markets Commission, which began its operations in 1972. The full development of its role and objectives took shape during the 1990s.

- In 1970, Greece introduced the institutions of Mutual Funds and Portfolio Investment Companies.

- Following the Turkish invasion of Cyprus in 1974, the Stock Exchange suspended its operations, resuming them in September of the same year.

1980-1999: Modernization and New Markets

- In February 1991, the Central Securities Depository (CSD) was established to manage the clearing of transactions.

- Between 1991 and 1992, the Parallel Market was introduced, which later became the foundation for the current Alternative Market.

- At the same time, the Athens Stock Exchange launched an automated electronic trading system, bringing an end to 116 years of open outcry trading.

- In 1995, as part of the capital market modernization effort, the Athens Stock Exchange was transformed into a public limited company, with the Greek State as the sole shareholder.

- In 1997, the Greek State sold 39.67% of the Athens Stock Exchange's share capital through a private placement. In 1998, a second private placement offered about 12% of shares to select investors. By 1999, the Greek State’s stake was further reduced to 47.7%.

- In 1997, the Athens Stock Exchange began collaborating with the international FTSE group.

- In 1999, the Athens Derivatives Exchange (ADEX) and the Clearing House for Derivatives Transactions (ETHESEP) were established, with the first derivatives products beginning to trade in August.

- Also in 1999, the process of dematerializing shares began, replacing physical certificates with electronic entries in the Securities System. In November 1999, the OASIS electronic trading platform replaced the old ASIS system, providing enhanced access to both equity and derivatives markets.

- The 1999 Parnitha earthquake led to the temporary closure of the Athens Stock Exchange on September 9 and 10.

2000-2009: Development and Internationalization of the Markets

- In March 2000, Hellenic Exchanges S.A. (HELEX) was established as a holding company.

- In August 2000, Hellenic Exchanges S.A. was listed on the Athens Stock Exchange.

- In September 2002, the merger between Athens Stock Exchange S.A. and Athens Derivatives Exchange S.A., both subsidiaries of HELEX, was completed, resulting in the creation of Athens Stock Exchange S.A..

- In June 2003, as part of its privatization program, the Greek State sold its entire stake in HELEX to seven banks. The Athens Stock Exchange transferred its remaining supervisory responsibilities to the Capital Markets Commission.

- In February 2004, HELEX acquired the minority stakes in its subsidiaries CSD and ETHESEP, increasing its ownership to 100%. In March 2005, HELEX merged with its subsidiary Capital Market Systems and Support Development S.A. (CMSD), renaming the new entity Hellenic Exchanges S.A. Holdings, Clearing, Settlement & Registration.

- In October 2006, a joint trading platform between the Athens Stock Exchange and the Cyprus Stock Exchange was launched, initiating a broader and more integrated partnership with the Cypriot market.

- In July 2007, HELEX moved its operations to its new headquarters at 110 Leoforos Athinon, while the historic building at 10 Sofokleous Street closed its doors as the exchange’s home for the final time in December 2007.

- In January 2008, the first Exchange Traded Fund (ETF) was introduced to the Greek market.

- In February 2008, the Alternative Market (EN.A.) was launched, with nine companies listing their shares within its first year of operation.

- On September 2, 2009, the Stock Exchange faced a ‘black day’ when a terrorist attack caused a powerful explosion, severely damaging half of the building. Fortunately, there were no casualties. Despite extensive damage, the Athens Stock Exchange resumed operations the very next day, and the building was fully restored to its original state by January 2010.

2010-2020: Evolution and Digital Transformation

- In 2010, the transaction clearing division was spun off from HELEX and transferred to its fully-owned subsidiary, Athens Exchange Clearing House S.A..

- In December 2011, the GREK ETF, which tracks stocks listed on the Athens Stock Exchange, was launched on the New York Stock Exchange.

- On December 1, 2014, a new trading and clearing model was implemented for the Derivatives Market, creating a unified system for trading all Athens Stock Exchange products (equities, derivatives) and streamlining transaction clearing and settlement processes.

- In 2014, the Athens Exchange Group obtained the ISO 22301:2012 Business Continuity Certification, covering all its companies, operations, and services provided.

- On June 29, 2015, the imposition of Capital Controls led to the longest closure in the Greek Stock Exchange’s modern history. The exchange reopened on August 3, 2015.

- In 2016, the Athens Stock Exchange introduced the Electronic Book Building (EBB) service, providing companies and market participants with an efficient electronic platform for book-building.

- In 2018, the Hellenic Energy Exchange S.A. was launched, with the Athens Stock Exchange holding a 21% stake.

- In 2018, the Athens Stock Exchange became a member of the UN Sustainable Stock Exchanges initiative.

- In 2019, the Athens Stock Exchange acquired a 0.78% stake in the Kuwait Stock Exchange.

- In 2019, the "ATHEX ESG Reporting Guide" is introduced, a practical tool for companies to identify and report Environmental, Social, and Governance factors. The guide was updated in 2022 and 2024 to reflect evolving standards.

- Amid the COVID-19 pandemic, the Athens Exchange Group quickly launched the AXIA e-Shareholders Meeting platform in 2020, allowing companies to hold their General Meetings remotely and in real time. This service has since become widely adopted by listed companies.

2021-Present: New Partnerships and Sustainability

- In 2021, the Athens Stock Exchange formed a strategic partnership with the Belgrade Stock Exchange (BELEX), acquiring a 10.24% stake in BELEX. This collaboration led to BELEX’s trading activities being integrated into the Athens Stock Exchange’s platform, fostering deeper regional connectivity.

- In December 2021, the Athens Stock Exchange completed its investment in a cutting-edge Active-Active Data Center Architecture, which fully operationalized its business activities through the Group’s Alternative Data Center, finalizing a three-year infrastructure modernization initiative.

- In 2023, the Day-Ahead Market of the Albanian Power Exchange (ALPEX) officially launched, with the Athens Stock Exchange (ATHEX) and the Hellenic Energy Exchange (EnExGroup) providing crucial infrastructure and services to support its trading and post-trading operations.

- In the same year, the Athens Stock Exchange launched the ATHEX ESG Data Portal, a centralized hub for collecting and sharing ESG data. This platform streamlines access to standardized, comparable ESG information for both Greek-listed and non-listed companies, providing a valuable tool for investors focused on sustainable investment practices.

- In 2024, the upgraded Linux OASIS Trading System was launched, a high-performance platform designed for greater speed and efficiency. This technological advancement underscores the Group's commitment to innovation and improving market infrastructure.

- On December 11, 2024, the Group unveiled a comprehensive rebranding, modernizing its corporate identity while honoring its storied history.