Trading Model

The Athens Stock Exchange fully adheres to the MiFID II directive and operates as an order driven market, featuring Market Makers. It ensures transaction anonymity, prioritizes by price/time, and utilizes an Automated Volatility Control Mechanism.

Each market within the Athens Stock Exchange has a specific trading board supporting certain trading methods, with defined trading periods and phases. Specific categories of products are designated for each market, and each product is traded exclusively within its respective market.

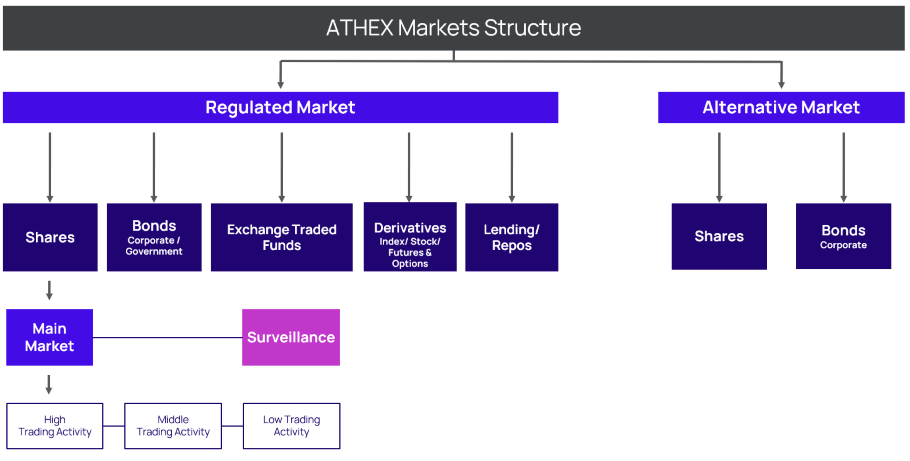

Securities Market Structure

Listed Issuers are categorized into different markets on the Athens Stock Exchange, primarily based on their market capitalization. The products traded in the Securities Market include:

- Equities

- Bonds

- ETFs

- Structured Products

- Warrants

Derivatives Market Structure

The products in the derivatives market are categorized into sub-markets based on their type and include:

Lending Products

ATHEX Market trades Lending Products (or Repos).

Market Making

The Market Maker provides liquidity to products for which the member acts as a Market Maker, either on behalf of clients or for its own account. Overall, Market Makers participate by 20% to ATHEX daily volume.

The evaluation of Market Makers in the Securities & Derivatives Market considers the following criteria:

- The alarms received on a monthly basis by Market Makers when they fail to fulfill their obligations

- The participation of the Market Makers in improving the liquidity of the instrument

- Specifically for the Securities Market, the evaluation includes two additional criteria related to enhancing equities’ trading activity:

- Moving the share to a higher liquidity class

- Increasing the average velocity of equities in the Middle Trading Activity Class by 1 basis point (bps)

- Moving the share to a higher liquidity class

The adherence to these criteria serves as a vital tool for assessing the impact of having a Market Maker on a financial instrument. This provides a clear indication of whether Market Makers are fulfilling their obligations appropriately within their roles. As an incentive for Market Makers to properly meet their obligations, a portion of the commissions collected by ATHEXGROUP is reimbursed to them.

Trading Hours

Learn More about ATHEX's Trading Calendar, ATHEX Cash Market Schedule and ATHEX Derivatives Market Schedule.

Trading on the Athens Stock Exchange takes place from 10:15 AM to 5:20 PM.