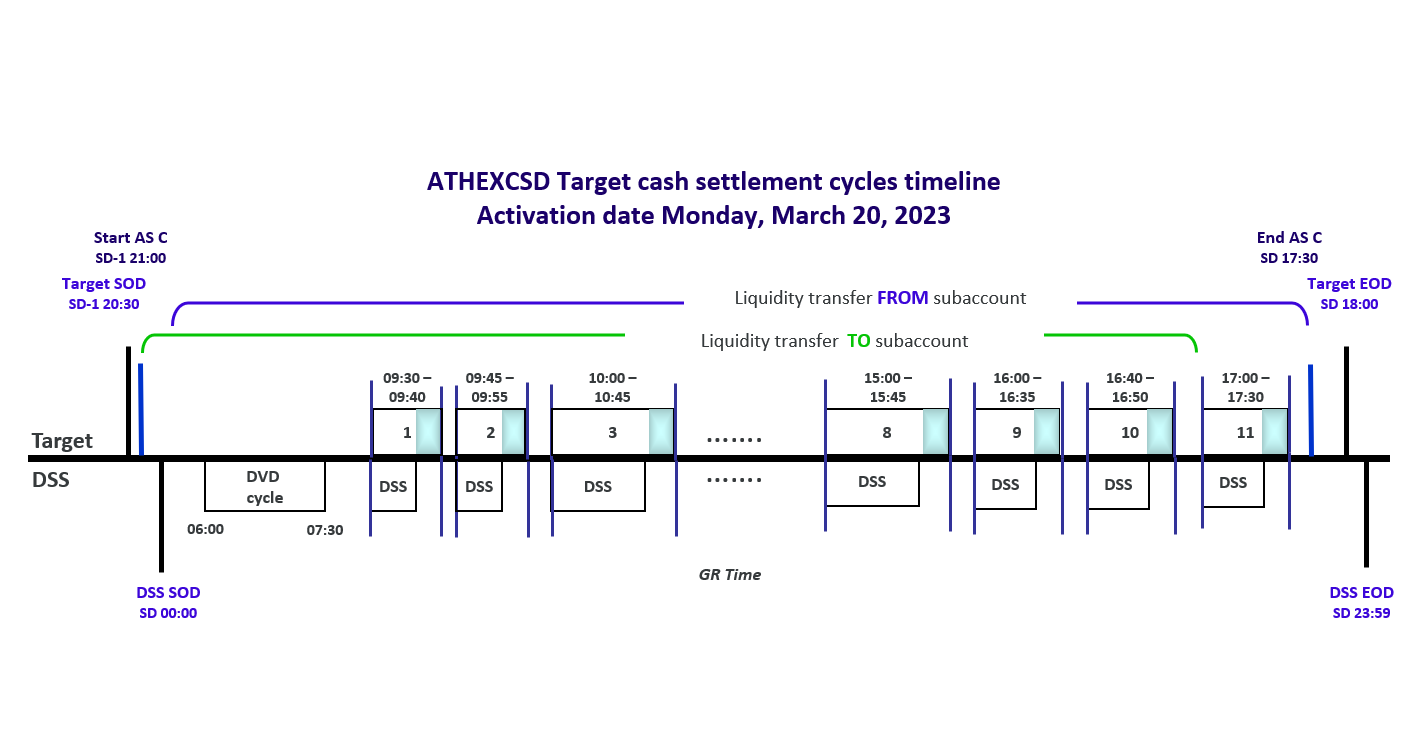

Cash Settlement Services

ATHEXCSD is a direct member of TARGET (the ECB Euro payment system). Through the ATHEXCSD Ancillary System, it provides real time cash payments to/from market Participants. For this purpose, each market Participant must be serviced by a Settlement Bank that participates in ATHEXCSD ASI.

The ATHEXCSD System provides to its Participants detailed information about the daily financial obligations, and the current cash balances, as well as detailed cash transactions.

Timings

| SETTLEMENTS | TYPE |

| Settlement, SDR Penalty and Tax Calendar 2025 | Download PDF  |

| Settlement, SDR Penalty and Tax Calendar 2024 | Download PDF  |

| Settlement, SDR Penalty and Tax Calendar 2023 | Download PDF  |

| Settlement, SDR Penalty and Tax Calendar 2022 | Download PDF  |

Learn more about the indicative DSS settlement procedures executed per Target cycle here.

1st cycle 9:30 – 9:40

- Derivatives

- Fees

- Daily cash settlement

- Securities

- OTC instructions settlement GR securities

- OTC instructions settlement foreign securities

2nd cycle 9:45 – 9:55

- Derivatives

- Fees

- Daily cash settlement

3rd – 8th cycle 10:00 – 10:45 and on the hour

- Securities

- Fees

- ATHEX trades Multilateral Settlement

- Bilateral Settlement block trades

- OTC instructions settlement GR securities

- OTC instructions settlement foreign securities

- Derivatives

- Physical delivery

- Possibility of executing extra daily cash settlements

- CA cash distributions

- Cash distributions on foreign securities

- Cash distributions on GR securities

9th cycle 16:00 – 16:35

Same as cycles 3-8

10th cycle 16:40-16:50

Same as cycles 3-8

Last opportunity to settle Shifted Transactions

11th cycle 17:00-17:30

Same as cycles 3-8

Last opportunity to settle spot1 buy-in trades and “failed trades"