New FTSE Med-100 Index.

FTSE Med 100 is the first index of that kind, i.e. an index that includes shares of more than one stock exchange and is calculated in real time. The new index was designed in order to monitor the return of the largest listed companies of the Eastern Mediterranean Markets and finally to facilitate and attract new investment capital in the broader area. The markets that initially will participate in the new index are these of Greece, Cyprus and Israel. In that context, it is designed in the near future to be included in the index also other markets of the broader area of Eastern Mediterranean.

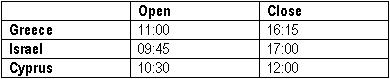

The values of the index and the calculation will be expressed in euro taking into account the current exchange parities of the spot market (spot rates) of the three currencies (Euro, Cyprus pound and Shekel). The calculation will be realized in real time from 09:45 until 17:00 (Greece) and will be distributed every single minute. The above period of time obviously takes into account (covers) the trading hours of the shares of the three Stock Exchanges, i.e.

Very significant fact is that the index is suitable for the design and development of derivative products including ETFs.

Eligible to participate in the new index are the shares of the three markets that participate in FTSE All-World Country Index and FTSE CySE 20 Index. The shares will be selected taking into account their market capitalization, whereas the shares of holding and investment companies that meet special criteria, as provided by the Ground Rules of FTSE Indices (rule 850) will not participate in the index.

The basis of the index is 5,000 units. Responsible for the revision of the index, the selection of the participant shares, as well as the changes and modification of the Ground Rules is FTSE Med Index Committee, which consists of representatives of the stock exchanges that participate and of FTSE representatives.

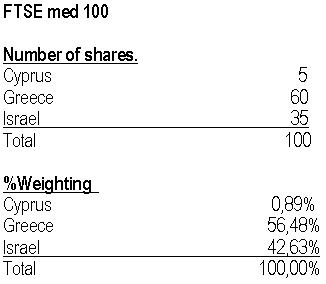

The weights and participations of the constituents of the three stock exchanges, based on the data of 30.5.2003 are as follows:

The constituents from the three stock exchanges, as they were calculated according to the weightings provided by the Ground Rules are given in the attached table.

Note:

The Ground Rules, the companies that will participate in the index as well as the main fundamentals of the companies will be shortly available at www.ase.gr.