Information about the ATHEX INDICES REVIEW held on 20/10/2003.

ATHEX COMPOSITE SHARE PRICE INDEX

The ATHEX Composite Share Price Index, up to its current composition represented 76.70% of the average market value and 72.18% of the value of transactions of the Main Market, without share blocks, for the review period (01/04-30/09). In the index participated 18 constituents of the FTSE/ASE 20 Index, 25 of the FTSE/ASE Mid 40 and 13 of the FTSE/ASE SmallCap 80, respectively, while the total number of shares was derived from 29 different economic activity sectors of the ATHEX.

With its new composition, where 11 shares were replaced by 11 new shares, the Composite Share price Index of the Main Market represents henceforth 76.89% of the average market value and 74.05% of the value of transactions of the Main Market, without share blocks, for the same review period (01/04-30/09). The Composite Share Price Index also comprises 18 additional shares of the FTSE/ASE 20 Index, 26 of the FTSE/ASE Mid 40 and 13 of the FTSE/ASE SmallCap 80 Index, while the total number of shares derives from 29 different economic activity sectors of the ATHEX.

In the new composition of the Composite Share Price Index of the Main Market, the share with the largest contribution was that of Hellenic Telecommunications Organization S.A. by 9.71%, while the share with the smallest contribution was that of LOGIC DATA INFORMATION SYSTEMS S.A. by 0.13%. Also, the index?s average market value during the review period reached 52.222 million euros.

ATHEX PARALLEL MARKET PRICE INDEX

The ATHEX Parallel Market Share Price Index, up to its current composition represented 57.13% of the average market value and 61.80% of the value of transactions of the Parallel Market, without share blocks, for the review period (01/04-30/09). In the index participated 3 constituents of the FTSE/ASE Mid 40 and 16 of the FTSE/ASE SmallCap 80, respectively, while the total number of shares was derived from 19 different economic activity sectors of the ATHEX.

With its new composition, where 7 shares were replaced by 7 new shares, the Composite Share Price Index of the Parallel Market represents henceforth 62.18% of the average market value and 68.57% of the value of transactions of the Parallel Market, without share blocks, for the same review period (01/04-30/09). The index also comprises 3 additional shares of the FTSE/ASE Mid 40 and 20 shares of the FTSE/ASE SmallCap 80 Index, while the total number of shares derives from 20 different economic activity sectors of the ATHEX.

In the new composition of the Composite Share price index of the Parallel Market, the share of the company INTRALOT S.A. contributed the most by 14.94%, while the share of IMAKO MEDIA NET GROUP S.A. contributed only by 0.53%. Also, the index?s average market value reached 3.704 million euros during the review period (01/04-30/09).

ATHEX HIGH VELOCITY INDEX

The ATHEX High Velocity Index, up to its current composition represented 1.35% of the average market value and 8.30% of the value of transactions without share blocks of the three and five-hour continuous trading markets for the review period (01/04-30/09). In the index participated 1 constituent of the FTSE/ASE Mid 40 and 6 of the FTSE/ASE SmallCap 80, respectively, while the total number of shares was derived from 11 different economic activity sectors of the ATHEX.

The average weighted velocity of shares, which constitute this index is 424.47%, where the share of the company INFORMATICS S.A. presented the largest weighted velocity by 1,164.87%, while the share of VIVERE ENTERTAINMENT COMMERCIAL & HOLDINGS S.A. demonstrated the smallest weighted velocity by 278.09%.

With its new composition, where 9 shares were replaced by 9 new shares, the High Velocity Share price index represents henceforth 1.54% of the average market value and 12.35% of the value of transactions without share blocks of the three and five-hour trading markets for the same review period (01/04-30/09).

The index also comprises 2 additional shares of the FTSE/ASE Mid 40 and 6 shares of the FTSE/ASE SmallCap 80 Index, while the total number of shares derives from 13 different economic activity sectors of the ATHEX.

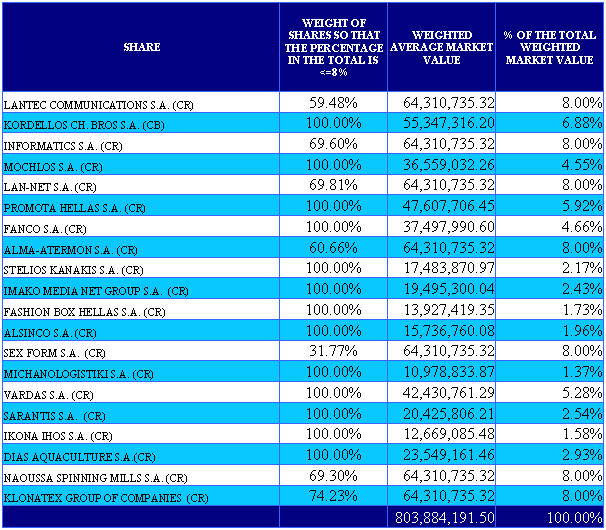

The average weighted velocity of shares, which constitute the new index is 627.39% (a 47.81% change), where the share of the company LANTEC COMMUNICATIONS S.A. presented the largest weighted velocity by 1,228.05%, while the share of KLONATEX GROUP OF COMPANIES S.A. demonstrated the smallest weighted velocity by 435.86%. Also, the average market value of the ATHEX High Velocity Index amounts to 1,134 million euros for the review period.

In the following table, the shares? weighting percentage, which constitutes the Index, is presented so that each share?s participation percentage of the period, on total average market value does not exceed 8.00%.

ATHEX INDUSTRIAL PRICE INDEX

The ATHEX Industrial Share Price Index, up to its current composition represented 85.39% of the average market value and 83.59% of the value of transactions of industrial companies, without share blocks, for the review period (01/04-30/09) and was comprised of 47 constituents. In the index participated 6 shares of the FTSE/ASE 20, 13 of the FTSE/ASE Mid 40 and 15 of the FTSE/ASE SmallCap 80, respectively, while the total number of shares was derived from 15 different economic activity sectors of the ATHEX.

With its new composition, the number of shares participating in the index is henceforth 49, while 4 shares were added and 2 were deleted, the Industrial Share price index represents henceforth 86.94% of the average market value and 83.75% of the value of transactions of industrial companies, without share blocks, for the same review period (01/04-30/09).

The index also comprises 6 additional shares of the FTSE/ASE 20, 13 of the FTSE/ASE Mid 40 and 19 shares of the FTSE/ASE SmallCap 80 Index, while the total number of shares derives from 14 different economic activity sectors of the ATHEX.

In the new composition of the Industrial Share price index, the share of the company COCA-COLA HELLENIC BOTTLING COMPANY S.A. contributed the most by 25.24%, while the share of IMAKO MEDIA NET GROUP S.A. contributed the less by 0.14%. Also, the index?s average market value amounted to 13,951million euros during the review period (01/04-30/09).