History

History

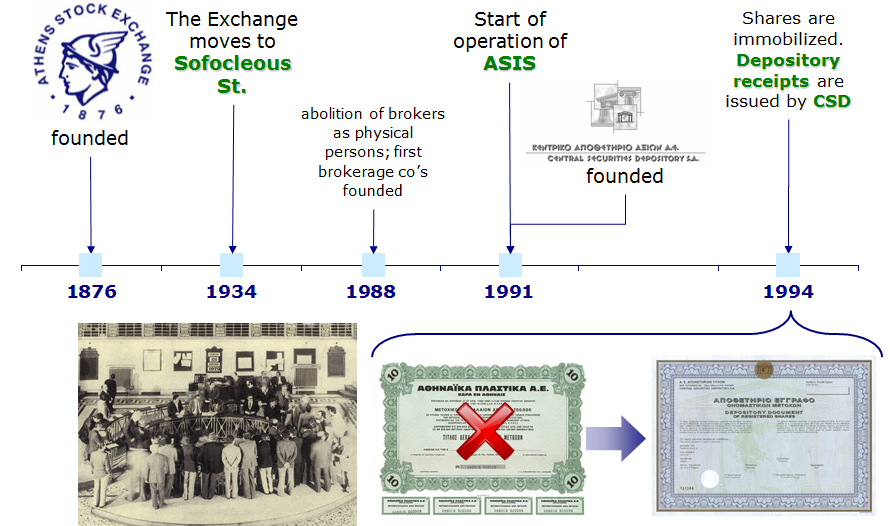

| 1876 - 1994 |

In 1876 the Athens Stock Exchange (ASE) is founded as a self regulated public organization

In 1876 the Athens Stock Exchange (ASE) is founded as a self regulated public organization

In 1918 ASE is transformed into a public entity

In 1918 ASE is transformed into a public entity

In 1991 the first electronic trading system (ASIS) is put into operation at ASE, abolishing the open-outcry method. In February 1991, the Central Securities Depository (CSD) is founded, for the clearing of transactions.

In 1991 the first electronic trading system (ASIS) is put into operation at ASE, abolishing the open-outcry method. In February 1991, the Central Securities Depository (CSD) is founded, for the clearing of transactions.

In 1995, as part of the efforts to modernize the capital market, ASE is transformed into a societe anonyme, with the Greek State as the sole shareholder.

In 1995, as part of the efforts to modernize the capital market, ASE is transformed into a societe anonyme, with the Greek State as the sole shareholder.

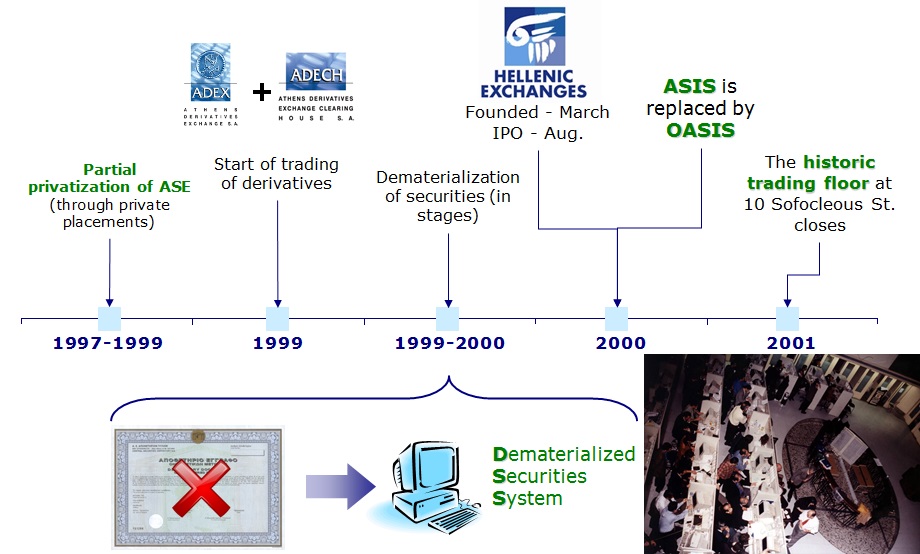

| 1997 - 2001 |

In 1997 the Greek state, through a private placement, sells 39.67% of the ASE share capital, while in 1998, through a second private placement, sells approximately 12% of the share capital to selected investors. In 1999 the State's stake is further reduced to 47.7%.

In 1997 the Greek state, through a private placement, sells 39.67% of the ASE share capital, while in 1998, through a second private placement, sells approximately 12% of the share capital to selected investors. In 1999 the State's stake is further reduced to 47.7%.

In 1999 the Athens Derivatives Exchange (ADEX) and the Athens Derivatives Exchange Clearing House (ADECH) begin operations, and in August 1999 the first derivative products are traded.

In 1999 the Athens Derivatives Exchange (ADEX) and the Athens Derivatives Exchange Clearing House (ADECH) begin operations, and in August 1999 the first derivative products are traded.

In 1999 the share dematerialization project begins - the paper depository receipts are gradually replaced by electronic book entries in the Dematerialized Securities System (DSS). In November 1999 the OASIS electronic trading system is put into operation, replacing ASIS.

In 1999 the share dematerialization project begins - the paper depository receipts are gradually replaced by electronic book entries in the Dematerialized Securities System (DSS). In November 1999 the OASIS electronic trading system is put into operation, replacing ASIS.

In March 2000, Hellenic Exchanges (HELEX) is founded as a holding company.

In March 2000, Hellenic Exchanges (HELEX) is founded as a holding company.

In August 2000 HELEX is listed on the Athens Stock Exchange.

In August 2000 HELEX is listed on the Athens Stock Exchange.

In April 2001 the ASE trading floor at 10 Sofokleous Street is closed.

In April 2001 the ASE trading floor at 10 Sofokleous Street is closed.

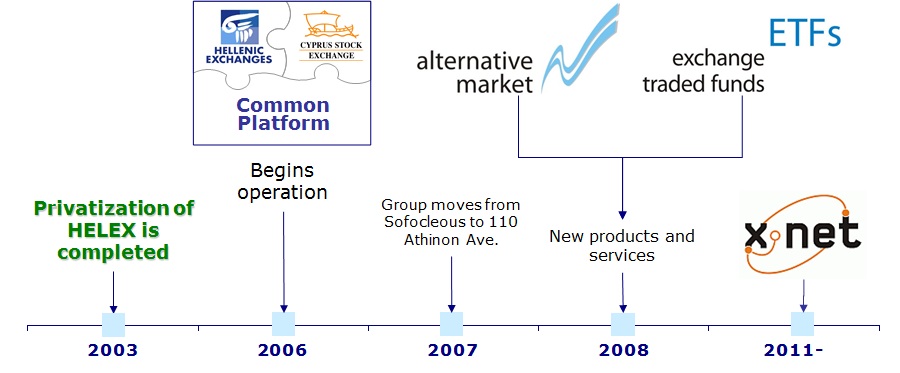

| 2002 - 2011 |

In September 2002 the merger of the Athens Stock Exchange and the Athens Derivatives Exchange, both HELEX subsidiaries, is completed. The name of the new entity is "Athens Exchange" (ATHEX).

In September 2002 the merger of the Athens Stock Exchange and the Athens Derivatives Exchange, both HELEX subsidiaries, is completed. The name of the new entity is "Athens Exchange" (ATHEX).

In June 2003, the Greek state, as part of the privatization program, sells the remaining HELEX shares it held to 7 banks. ATHEX transfers its remaining regulatory responsibilities to the Hellenic Capital Market Commission.

In June 2003, the Greek state, as part of the privatization program, sells the remaining HELEX shares it held to 7 banks. ATHEX transfers its remaining regulatory responsibilities to the Hellenic Capital Market Commission.

In February 2004 HELEX purchases minority stakes in its subsidiaries CSD and ADECH, taking its participation to 100%, while in March 2005 the merger with its subsidiary Systems Development and Support House of the Capital Market (ASYK) is completed.

In February 2004 HELEX purchases minority stakes in its subsidiaries CSD and ADECH, taking its participation to 100%, while in March 2005 the merger with its subsidiary Systems Development and Support House of the Capital Market (ASYK) is completed.

On the 30th of October 2006 the Common trading and clearing Platform between ATHEX and the Cyprus Stock Exchange is put into operation. With this cooperation, the two markets are connected and investors gain access to both markets.

On the 30th of October 2006 the Common trading and clearing Platform between ATHEX and the Cyprus Stock Exchange is put into operation. With this cooperation, the two markets are connected and investors gain access to both markets.

In November 2006 the merger of HELEX with its subsidiaries CSD and ADECH is completed. The name of the new company is changed to "Hellenic Exchanges S.A. Holding, Clearing, Settlement and Registry."

In November 2006 the merger of HELEX with its subsidiaries CSD and ADECH is completed. The name of the new company is changed to "Hellenic Exchanges S.A. Holding, Clearing, Settlement and Registry."

In July 2007 the relocation of the departments of the Group to the new privately owned building at 110 Athinon Ave. begins. In December 2007 the historic building at 10 Sofokleous St. closes its doors for the last time as an exchange.

In July 2007 the relocation of the departments of the Group to the new privately owned building at 110 Athinon Ave. begins. In December 2007 the historic building at 10 Sofokleous St. closes its doors for the last time as an exchange.

In January 2008 the first ETF (Exchange Traded Fund) starts trading in the Greek market.

In January 2008 the first ETF (Exchange Traded Fund) starts trading in the Greek market.

In February 2008 the operation of the Alternative Market (ENA) begins. By the end of 2008, 9 companies listed their shares in that market.

In February 2008 the operation of the Alternative Market (ENA) begins. By the end of 2008, 9 companies listed their shares in that market.

In June 2008, Mr. Spyros Capralos, Chairman of Athens Exchange and CEO of HELEX is elected President of the Federation of the Federation of European Securities Exchanges (FESE). The term of the FESE President is two years.

In June 2008, Mr. Spyros Capralos, Chairman of Athens Exchange and CEO of HELEX is elected President of the Federation of the Federation of European Securities Exchanges (FESE). The term of the FESE President is two years.

On the 30th of March 2009, Link Up Markets - a joint venture between Depositories that is providing cross-border transaction settlement services, in which HELEX participates as one of the founding members - began operations, while in June 2009 the first link by HELEX as Issuer CSD with the Swiss depository SIS SegaInterSettle AG was made.

On the 30th of March 2009, Link Up Markets - a joint venture between Depositories that is providing cross-border transaction settlement services, in which HELEX participates as one of the founding members - began operations, while in June 2009 the first link by HELEX as Issuer CSD with the Swiss depository SIS SegaInterSettle AG was made.

On the 2nd of September 2009 the HELEX Group was the victim of a terrorist attack, by an explosive device which was placed in a trapped vehicle in a side street of the building. The bomb blast caused extensive material damage to the building at Athinon Avenue. Despite the almost complete destruction of half of the building, the exchange operated as usual from the first day of the terrorist attack. The renovation of the building to its original state was completed in January 2010.

On the 2nd of September 2009 the HELEX Group was the victim of a terrorist attack, by an explosive device which was placed in a trapped vehicle in a side street of the building. The bomb blast caused extensive material damage to the building at Athinon Avenue. Despite the almost complete destruction of half of the building, the exchange operated as usual from the first day of the terrorist attack. The renovation of the building to its original state was completed in January 2010.

The Xnet network is activated.

The Xnet network is activated.

20240917 Bank of Cyprus Holdings plc - Summary Document-ENG-Final.PDF

20240917 Bank of Cyprus Holdings plc - Summary Document-ENG-Final.PDF  AUTOHELLAS_PROSPECTUS.pdf.crdownload

AUTOHELLAS_PROSPECTUS.pdf.crdownload

Resolution No 22 Regulation of Technical Matters for Trading on ATHEX Markets 22042024

Resolution No 22 Regulation of Technical Matters for Trading on ATHEX Markets 22042024