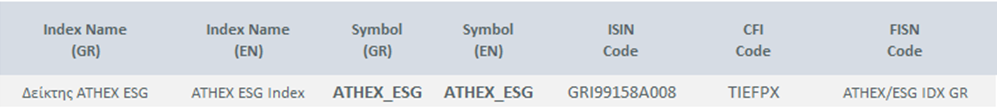

Characteristics - Methodology - Composition ATHEX ESG Index

|  | ||

| Characteristics - Methodology - Composition ATHEX ESG Index | |||

| |||

- Index Characteristics

|

- Number of Constituents: 60

- Index Type: Weight Capitalization

- Starting Price: 1,000units

- Start of Calculation: 02/08/2021

- Review: Semi annually (May, November)

- Capping: Semi annually (June, December)

- ESG Evaluation

Listed companies on the Athens Stock Exchange are evaluated based on the level of transparency they exhibit regarding the indicators of the "ESG Information Disclosure Guide" according to the "ESG Transparency Methodology." Each listed company receives a final score, known as the "ESG Transparency Score" The "ESG Transparency Score" of each company is considered as a criterion for inclusion in the composition of the index.

- Eligibility Criteria

- Companies listed on ATHEX Main Market

- Minimum free float greater than 15%

-

«ESG Transparency Score» greater than or equal to 30%

- Selection Process

- Companies fulfilling the eligibility criteria are ranked in descending order based on their ESG scoring

- The first 60 companies of the rank are included in the index composition

- Weight Process

- A methodology is adopted for determining the weight of each constituent in the total capitalization of the index which takes into account the «ESG Transparency Score» of each constituent.

- The capitalization of each company is weighted with a factor resulting from the product of the Free Float with the «ESG Transparency Score»

- Maximum weight of each constituent up to 10% of the total capitalization of the index (Capping Process)

See here the composition of the Index

See here the ATHEX ESG Index Ground Rules

About Athens Exchange Group

The Athens Stock Exchange since its establishment in 1876, consistently participate in the financial and business developments in the country.

Athens Exchange Group (ATHEX Group), provides support to the Greek Capital Market. ATHEX Group operates the organized Equities and Derivatives markets, the alternative market and performs clearing and settlement of trades.

The Athens Stock Exchange, through its markets, offers solutions and financing tools to businesses, expands investor choice by providing a safe, stable and easy environment in full alignment with international practices and the European regulatory framework.

In a period that the role of stock markets in exploring alternative ways of financing business, at a European level, is significantly enhanced, the Athens Exchange Group has taken a series of initiatives to highlight the attractiveness of the Greek Capital Market and the Greek companies to the international investment community and expand the variety of investment opportunities.

Its shares are traded on the Main Market of the Athens Exchange (Symbol: EXAE).

The profiles of the ATHEX Group and its markets can be downloaded from the link. More information can be found in the website www.athexgroup.gr.

Alter Ego Media_IPO Prospectus 2025.pdf

Alter Ego Media_IPO Prospectus 2025.pdf  AUTOHELLAS_PROSPECTUS.pdf.crdownload

AUTOHELLAS_PROSPECTUS.pdf.crdownload  Resolution No 22 Regulation of Technical Matters for Trading on ATHEX Markets 22042024

Resolution No 22 Regulation of Technical Matters for Trading on ATHEX Markets 22042024