ATHEX Publishes ESG Reporting Guide

| |  | ||

| November 13th 2019 | |||

| ATHEX Publishes ESG Reporting Guide | |||

| |||

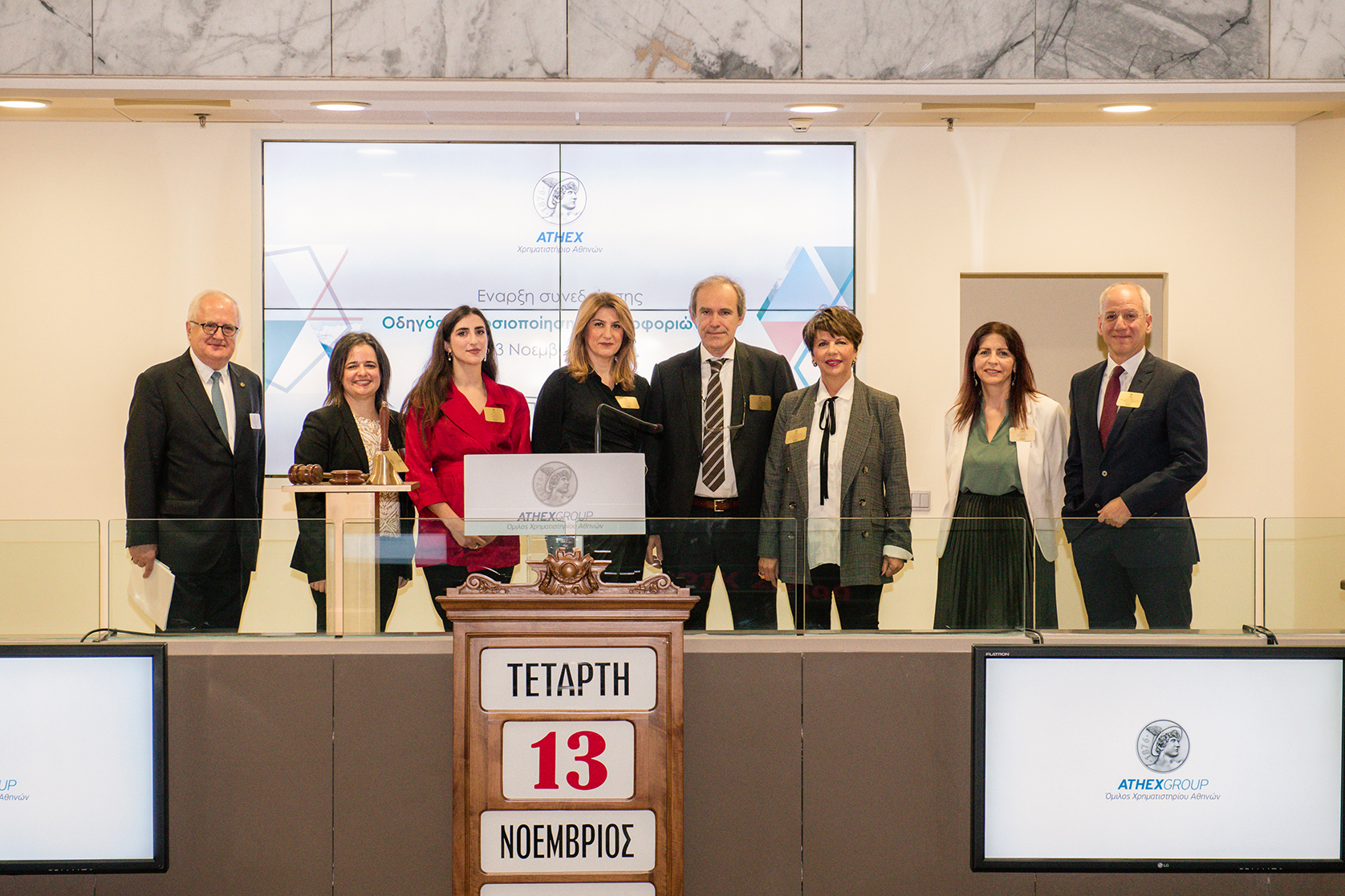

The Athens Stock Exchange launched the publication of its first ESG Reporting Guide, marking the occasion with an opening bell ceremony during which Mrs Natassa Stamou, the Vice Chair of the Hellenic Capital Markets Commission, rang the traditional bell.

The ESG Reporting Guide was developed in cooperation with Mr. George Serafeim, Professor at Harvard Business School, and KKS Advisors. This Guide is designed to function as a tool with which companies can identify the ESG issues they should consider disclosing and managing, on the basis of their impact on long-term performance. It also offers practical guidelines on the metrics companies should use to disclose this information and communicate it to investors and other stakeholders.

While the primary audience for this document are issuers listed on the Athens Stock Exchange, it can be a useful tool for companies of all sizes, across all sectors. Companies with a track record of reporting ESG information can further develop their activities using the best-practices outlined in this document, and those who are just starting out with non-financial disclosures can use it to guide their efforts towards ESG transparency and increased accountability on sustainability matters. The Athens Stock Exchange joined the Sustainable Stock Exchanges (SSE) initiative in 2018 by making a voluntary public commitment to promote improved ESG disclosure and performance among listed companies.

During her speech, Mrs Stamou stressed the importance of embedding sustainability in corporate strategy, and highlighted that "the Hellenic Capital Markets Commission supports initiatives that go beyond the metrics and focus on the ‘big picture', which is putting in place policies and practices that focus on long-term value creation for both the company and society". The President of the Athens Stock Exchange, Mr. George Handjinikolaou, added that "companies that adopt these practices have been shown to have greater access to capital, higher capitalization and more satisfied investors", recognizing that "the ESG Reporting Guide is an initiative that comes to join a range of actions undertaken by the Athens Stock Exchange with the aim of enhancing corporate governance in Greece".

Following the presentation of the Guide, the President of the CSR Committee of MYTILINEOS, Mrs Sophie Daskalaki-Mytilineou and Mr. Yiannis Paniaras, Chairman of the SEV Council for Sustainable Development and Executive Director, Greek Region of TITAN Group, participated in a conversation alongside the CEO of the Athens Stock Exchange, Mr. Socrates Lazaridis. The conversation was an opportunity to share their experience and highlight the benefits of good ESG practices for the company, society, the environment and stakeholders.

Mrs Daskalaki-Mytilineou expressed her strong belief that the ATHEX Guide can make a significant contribution in developing sustainable investments, adding that "MYTILINEOS has already, since 2013, integrated sustainability and ESG disclosure in its strategy, thus forming a real case study for facilitating the information flow between companies, investors and other social partners". Mr. Lazaridis stressed the central role of sustainable development globally, focusing on its importance for capital markets and "the impressive growing investor interest for companies with strong performance and transparency on ESG matters". To close, Mr. Paniaras emphasized that the ATHEX Guide "sends a powerful message, from inside the Stock Exchange, that an ever increasing number of shareholders recognize that in the long term, value is created by companies that have endorsed the principles of corporate governance and develop their strategy based on the three pillars of economy-environment-society".

The complete ESG Reporting Guide is available on the Athens Stock Exchange website.

| Download the Press Release |  |

About the Athens Exchange Group

The Athens Exchange Group (ATHEXGroup) operates the Greek cash and derivatives markets. The Group offers trading in stocks and derivatives through the Athens Stock Exchange (ATHEX); clearing through its subsidiary ATHEXClear; and settlement and registry services through its subsidiary Hellenic Central Securities Depository. Through the Hellenic Corporate Governance Council - collaboration with the Hellenic Federation of Enterprises - the Group provides corporate governance expertise and monitors the implementation of the Hellenic Corporate Governance Code.

As of June 2018, the Exchange has 203 listed companies, a market capitalization of €54.3bn, an average daily turnover of €69.3m and an average daily trading volume of 49.6m shares. The exchange has attracted significant capital flows from abroad; more than 64.6% of the total market capitalization is in the hands of international investors, who on average are responsible for 55.1% of trading activity by value.

ATHEX was listed on the Athens Stock Exchange in August 2000; it was fully privatized in 2003. Today, ATHEX has a market capitalization of €287m.

Alter Ego Media_IPO Prospectus 2025.pdf

Alter Ego Media_IPO Prospectus 2025.pdf  AUTOHELLAS_PROSPECTUS.pdf.crdownload

AUTOHELLAS_PROSPECTUS.pdf.crdownload  Resolution No 22 Regulation of Technical Matters for Trading on ATHEX Markets 22042024

Resolution No 22 Regulation of Technical Matters for Trading on ATHEX Markets 22042024